shiftdown

Seasoned Member

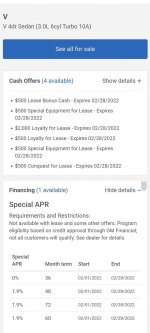

On my previous C8, I went through the dealer initially to finance. I ended up with a 3.7% rate they farmed out to US Bank. I'm sure that includes .5% or so dealer add on. I've heard people have obtained some killer rates through GM Financial on other models.

My car is at 4B00 now, so I'm starting to look around for what's going go be the best bet. Inclined to put about 50% down for now. My own credit union has offered me 2.59% which is livable should nothing better come up.

Purchasing through Sewell, so if you have direct experience, that would be awesome. Not applicable to Military type credit unions or anything that would take special requirements. Just your regular jackass off the street

So, if you financed, what did you end up with for an interest rate?

My car is at 4B00 now, so I'm starting to look around for what's going go be the best bet. Inclined to put about 50% down for now. My own credit union has offered me 2.59% which is livable should nothing better come up.

Purchasing through Sewell, so if you have direct experience, that would be awesome. Not applicable to Military type credit unions or anything that would take special requirements. Just your regular jackass off the street

So, if you financed, what did you end up with for an interest rate?